After Putin’s invasion of Ukraine back in February 2022, the West responded with some of the most wide-reaching sanctions ever. The UK government claimed that they ‘would cripple Russia's war machine' whilst Biden asserted that 'sanctions are devastating their economy'. But a year on, the predicted 15% collapse in GDP has not materialised and Putin’s capacity to wage war seems not to have been affected. Maria Demertzis, Senior fellow at Bruegel and part-time Professor of Economic Policy at the European University Institute in Florence, explains why.

When Russia first invaded Ukraine almost a year ago, many countries condemned the aggression and applied sanctions in an attempt to squash its economy and isolate it from global engagement. The expectation during the early days of the war was that the economy was going to contract by as much as 15%. Since then, those numbers have been heavily revised upwards and the latest forecasts by the IMF show a contraction as little as just over 2%, with moderate growth expected in 2023. In reality, many agree that the situation is not quite as rosy, particularly since data emerging from Russia is no longer reliable.

SUGGESTED READING

How we got Putin so wrong

By Stathis N. Kalyvas

SUGGESTED READING

How we got Putin so wrong

By Stathis N. Kalyvas

Nevertheless, the fact remains that Russian revenues have not been affected in a way that would have inhibited its ability to wage war. Three reasons explain that.

Russian energy exports remained for the most part unsanctioned. This is because the EU, the biggest energy importer for Russia, did not sanction Russian energy imports as it did not want to compromise its ability to meet its energy demands. In most of 2022 therefore, only about 8% of the export value of Russian energy was under sanctions, all of it by third countries. Given also the huge increases in energy prices, oil and gas revenues accounted for 45% of the Russian government budget.

Second, effective Russian economic policy prevented the economy from freefalling. The government provided support equivalent to 3% of GDP in the form of social benefits, tax breaks, subsidies for loans and by increasing the minimum wage. This is not dissimilar to the support given in EU countries to deal with the energy crisis. There was also an increase in government consumption to compensate for the big drop in investment and private consumption. At the same time, very swift and sizeable intervention by the Russian Central Bank stabilised the exchange rate (albeit at considerably lower trading volumes) and provided liquidity to the banking system. This prevented the economic crisis from turning into a financial crisis that would have put the economy into a self-fulling negative spiral. All in all, these measures managed to protect per-capita income and prevent poverty rates from increasing.

___

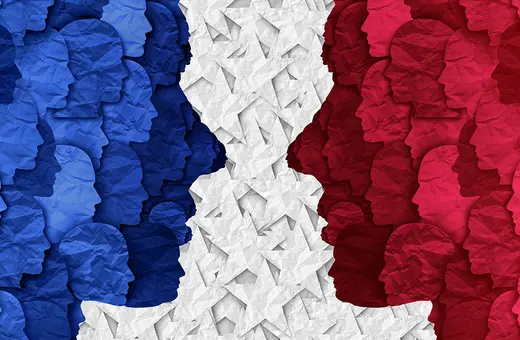

59% of the world’s total population is either neutral or endorses Russian aggression. This is of great significance because it indicates that many countries are not necessarily willing to isolate Russia by helping to enforce sanctions and stop economic ties with Russia

___

The third reason is because a big part of the world does not condemn Russia for its aggression against Ukraine. 59% of the world’s total population is either neutral or endorses Russian aggression. This is of great significance because it indicates that many countries are not necessarily willing to isolate Russia by helping to enforce sanctions and stop economic ties with Russia.

Join the conversation