In an uncertain world, it can be difficult to know who to trust and which voices to listen to. In the face of such uncertainty, perhaps the best people to look to are those who have been containing risk in a chaotic world all along, the insurers. Professor Louis Pauly argues that amid high profile examples of the state of Florida being largely uninsurable and Australia being described as “fast becoming an uninsurable nation”, we need to look to this industry to cut through the political noise and build solutions based on shared risk, joint responsibility, and cooperation before we all pay a premium on catastrophe.

We have always lived in an uncertain world. But, amidst the uncertainty surrounding us, human beings have become quite adept at carving out zones of risk that can potentially be governed. The social and financial technology of insurance developed on the foundation of this experience-based ingenuity. Today, when political polarisation makes it ever more difficult to govern mounting global risks, insurance and its history may open the road to effective solutions.

Coinciding with the appearance of early insurance firms was the state form of government, the ultimate provider of protection. Together, if mainly for the world’s relatively prosperous societies over the past few centuries, the insurance industry and the states supporting it and providing it with backstops worked to pool and cover various kinds of risk. This entailed aggregating and transferring the potential costs of insurable perils from those less able to manage them to others willing and able to bear them. Their specific consequences included the provision of physical and financial assistance during emergencies, the bolstering of societal resilience after accidents and catastrophes, and the supply of data-driven assessments aimed at preventing or preparing for future disasters. Without them, we would today be living in another world. Insurance made possible the dominant socio-economic system of modern capitalism, which now intricately if variably links states, societies, and markets across the planet.

___

In anticipation of staggering losses, moreover, government officials and insurers might have worked to make insurance more attractive and affordable.

___

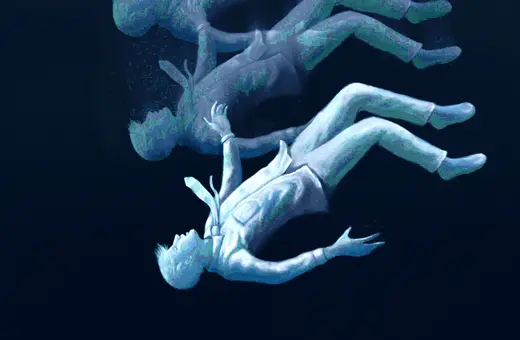

Beyond the vital issue of how that system can be reformed for the benefit of those left out, an urgent question confronts all of humanity today. In the face of new risks still shrouded in some uncertainty, like those arising from global warming and the dawn of artificial intelligence, has the system itself reached its limit? A story well told by economic historians puts the question into practical perspective.

It was hardly unusual in May 1861 for a strong south wind to blow through the mountain pass leading into Glarus, an emerging industrial town in the eastern part of Switzerland. Late one night, a small fire broke out on its edge. Within hours, eight residents were killed and 793 buildings, including two-thirds of its homes, were destroyed or damaged. When the smoke cleared, its citizens faced a monumental recovery challenge. Most of the households involved were desperate. They had no insurance. Forty percent of the ones who did were underinsured, and not many had any kind of coverage for the contents of their homes. The most exposed private insurance company found itself on the hook for one quarter of all covered losses. It was saved from bankruptcy when government agencies agreed to absorb a large chunk of unpayable debt. Pre-purchased public insurance covered some other losses, but even those policies had been badly under-priced. Town and regional governments themselves soon faced the prospect of bankruptcy.

Join the conversation